Private Sector · Regulated Banking · Advisory Services

Designing advisory workflows under regulatory constraints

Overview

Supporting a large, regulated bank to standardise advisory workflows and regulatory capture across segments, reducing risk and platform complexity before build.

My role

Service Designer — working with an offshore UX Lead as one of two designers, I contributed post-discovery workflow design, usability testing, and validation. I shaped service-level logic, conversation frameworks, and design inputs used by business, compliance, and technical teams to define build-ready requirements within an enterprise CRM platform.

What needed deciding

The challenge

The bank operated across retail, business, private, and institutional banking, serving over one million customers through advisory services delivered under strict regulatory requirements.

While compliance obligations were being met, advisory processes had evolved differently across segments. Regulatory capture was handled through varied interaction patterns, system configurations, and adviser workarounds. As delivery progressed, teams needed to decide how regulatory requirements could be handled more consistently during real adviser–customer conversations, without driving excessive platform customisation or increasing long-term maintenance risk.

A key tension sat between how advisers preferred to work and how regulatory capture needed to occur. Advisers generally preferred in-person meetings (or phone for some contexts) and often avoided using screens to preserve rapport. This resulted in handwritten notes and post-meeting data entry, creating risk around completeness, consistency, and timing of regulatory capture.

The programme needed clarity on:

where consistency was required to reduce regulatory and delivery risk

where variation was acceptable to support different advisory contexts

how much behaviour change could realistically be expected from advisers

The focus

To contribute design work that clarified how regulatory requirements and critical customer information could be captured more consistently during advisory conversations, while working within standard CRM components and realistic adviser behaviours.

How direction was shaped

Approach

Working within an agreed programme direction, I contributed to workflow design and validation alongside the UX Lead.

Regulatory requirements, current-state advisory practices, and CRM platform constraints were brought together into service-level workflow concepts and conversation frameworks. These were used to surface trade-offs, test assumptions, and define requirements before development.

The emphasis was on making regulatory and information-capture logic explicit, so teams could reason about consistency, variation, and behaviour change before decisions were locked into build.

One grounding insight

Current-state validation showed that advisers prioritised relationship quality over system interaction during face-to-face meetings. Screens were used sparingly, with key information captured through notes and entered later.

Designing workflows that assumed continuous system use would have required a significant shift in adviser behaviour. Surfacing this early helped reframe the problem from “how to capture everything in the moment” to how to support accurate, compliant capture without forcing unrealistic interaction patterns.

Key activities

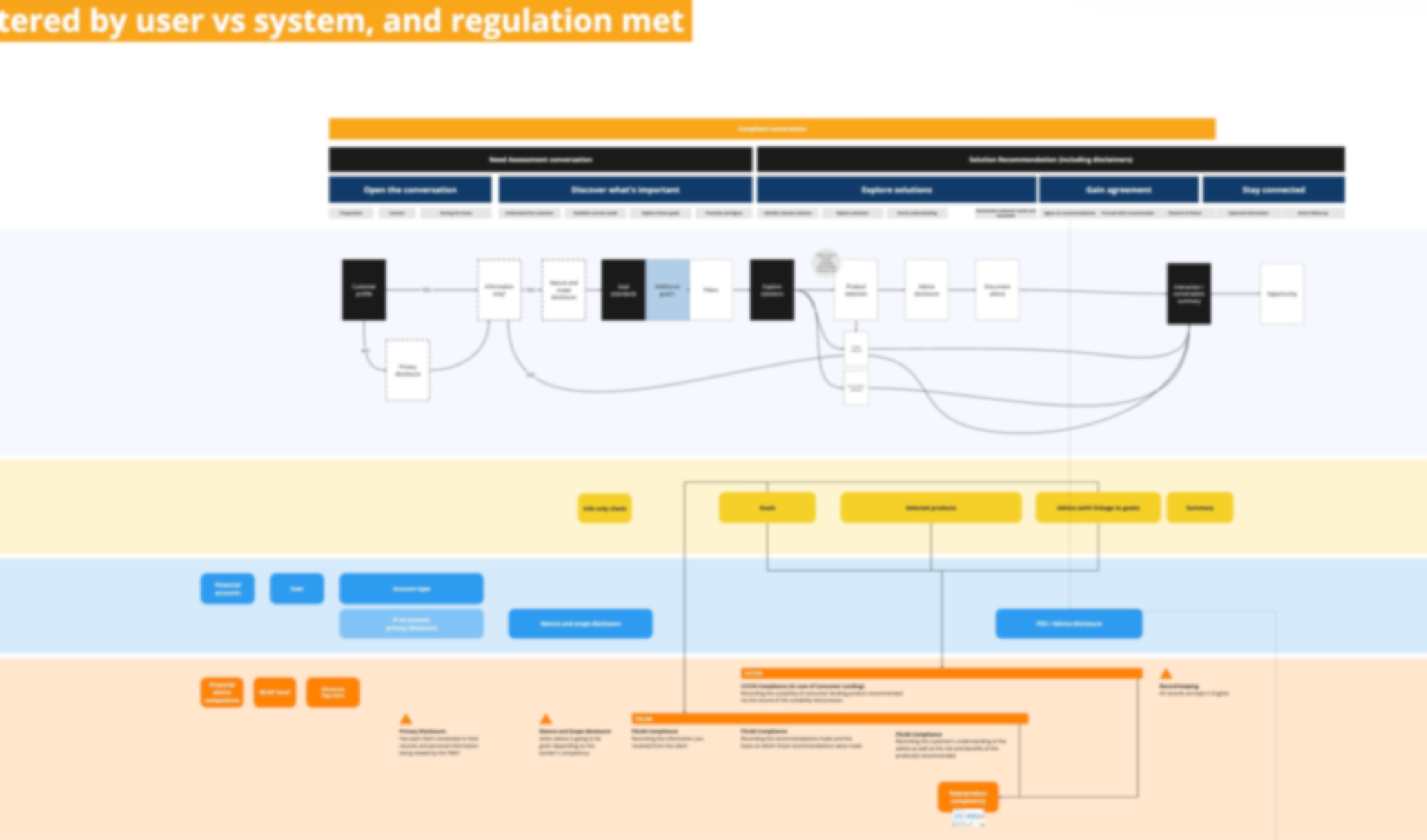

Developed service-level workflow concepts showing how regulatory and critical customer information could be captured across different advisory contexts

Defined conversation frameworks aligning regulatory requirements with how advisers actually conduct in-person and phone-based meetings

Planned and synthesised usability testing to validate workflow assumptions and behaviour-change implications

Worked with business and compliance stakeholders to confirm regulatory requirements were fully reflected and agreed

Contributions to key decisions

Clarified where regulatory capture needed to be standardised across segments to reduce compliance and platform risk

Identified where variation was necessary to support adviser behaviour without undermining consistency

Informed decisions about realistic in-meeting system use versus post-meeting capture and associated risk

Helped define build-ready workflow requirements using out-of-the-box CRM components

Service-level workflow logic used to reason about regulatory capture and interruption handling

Outcomes and implications

Deliverables

Design report consolidating insights, decisions, and service-level guidance for advisory workflows

Conversation frameworks and workflow concepts illustrating regulatory and information capture across advisory contexts

Usability testing findings validating assumptions and highlighting behaviour-change implications

Design inputs for build, defining requirements using standard CRM components and signalling complex areas

Outcomes and impact

Business and compliance stakeholders confirmed regulatory requirements were fully captured

Delivery teams had clearer guidance on feasible consistency and variation across segments

Workflow logic balanced adviser practice with compliance and platform sustainability

Critical customer information capture was surfaced early, reducing downstream delivery risk

Key learning

This work was as much about changing advisory ways of working as implementing a new system. Treating compliance as the structure for customer conversations — rather than a post-meeting checklist — helped anchor a more consistent, compliant advisory model.